- Tick symbol getting check list item reputation step one

What is actually a citizen Loan?

A homeowner financing offers an easy way to borrow huge amounts out-of currency, typically anywhere between ?step three,000 and ?100,000. It is only available to individuals which either own their property outright, or possess a mortgage having a chunk out-of security. Costs are usually made-over a time period of four to help you 20 ages and interest may vary. The key let me reveal that the property is used to ensure payments. Consequently for many who skip costs, your house could be repossessed and you will ended up selling to repay your debt.

Why would I Be cautious?

Citizen money are generally thought to be a past lodge, as if you earn towards the economic difficulties you could potentially beat their family. They want to not taken out to cover way too many expenditures including due to the fact a secondary. Repayments are often spread-over years of energy therefore monthly installments would be lower, nevertheless the overall amount of appeal paid back could be extremely higher. In place of signature loans, your own rate of interest is not always fixed, definition the lender increases the %Annual percentage rate once they such as for instance.

For those who have a dismal credit records: Citizen fund is easier to access than unsecured loans, which make all of them advisable of these which have bad credit histories. This is because the lender is taking reduced exposure, simply because they is also get well their funds of the repossessing your home in the event that your are not able to spend.

If you would like consolidate existing expenses: It means paying down your dated costs having that loan at good straight down rate of interest, which decrease month-to-month repayments as well as the level of notice paid off overall.

Yet not, be aware that of a lot loans has actually penalties for folks who pay-off them early. Get in touch with a totally free personal debt foundation such as for instance Action Change otherwise Federal Debtline to possess pointers in advance of combining obligations.

Do i need to Manage It?

Constantly borrow as low as you can, with the shortest big date you can easily. This will ensure you afford the minimal level of interest. Remember the expanded you spread your debt, the greater number of attention you’ll shell out.

Think twice how much you could potentially manage to spend for every single times. For example, if you obtain ?100,000 more 2 decades at the 5.7% desire, you will pay ? monthly. This is going to make the complete attention ?66,373 and when the rate remains an identical that it may not.

TotallyMoney’s customised borrowing review unit makes you examine additional loan quantity, as well as some other installment episodes, to disclose the real difference into the monthly obligations. This should help you to decide just how much you can afford so you’re able to use, as well as exactly what time period.

Opt Nebraska personal loans bad credit online for exactly how your position and you may funds could possibly get alter inside ten otherwise 20 years’ day will you nevertheless be able to pay the costs? Never ever, ever before obtain over your want.

Exactly what Interest rate Can i Spend?

The rate you are considering to your that loan will depend on your credit score. It might not always be the interest rate stated of the financial otherwise strengthening society. Merely 51% out-of winning applicants are given the latest member %Apr. The others is provided a high rate of interest, although some will only end up being rejected. Unfortuitously, you generally don’t know just what rate of interest you will be offered unless you get the loan.

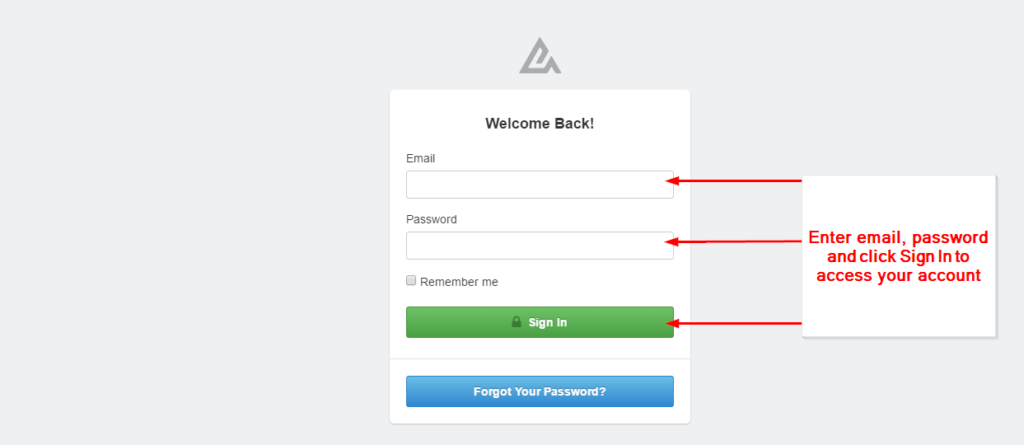

Making an application for a great amount of finance can damage your credit score, as finance companies can’t stand to see that you’ve come rejected multiple minutes. Luckily for us one TotallyMoney’s customised credit evaluation tool provider will tell you when you find yourself likely to be recognized having an effective citizen financing Before applying.

All of our complex qualification examining tech carries out a smooth look one will not leave a mark on their credit history. We do a comparison of several loan providers to provide you an over-all choices. It indicates you desire simply sign up for secure homeowner financing one you are sure that you likely will score.

Perform I’ve Enough Guarantee?

You could potentially normally only use normally equity since you have of your property. Collateral refers to the ratio of your house that you individual downright, instead of a mortgage. Such as for instance, when your home is worth ?150,000 and your an excellent home loan try ?fifty,000, then you’ve got ?100,000 off security.

Positives and negatives

Secured personal loans: Think carefully Just before Protecting Most other Costs Facing Your home. Your house May be REPOSSESSED Unless you Carry on with Repayments To your Home financing Or any other Personal debt Covered Inside it.

If you opt to take-out a citizen financing, you concur that your own personal information will be taken to a beneficial borrowing from the bank agent who’ll get in touch with your because of the cell and you may/otherwise email address to learn more about your requirements. This allows the brand new agent to ensure you are lead so you can financing products that satisfy individual standards and you can monetary items.

When you do and work out an application, the newest agent have a tendency to counsel you of every arrangement payment you’ll be able to become billed when you take away a loan.