Exactly how Reasonable Was USDA Lenders?

The united states Department off Agriculture (USDA) mortgage, known as the new (RD) mortgage, means zero advance payment that is offered to lower-borrowing applicants.

Interest in these types of finance is growing just like the consumers know its experts. More than 166,000 family utilized a USDA financing during the fiscal seasons 2015 by yourself, with respect to the service.

Visitors enthusiasm isnt surprising. The latest USDA financing is the simply currently available to own homebuyers without armed forces provider record.

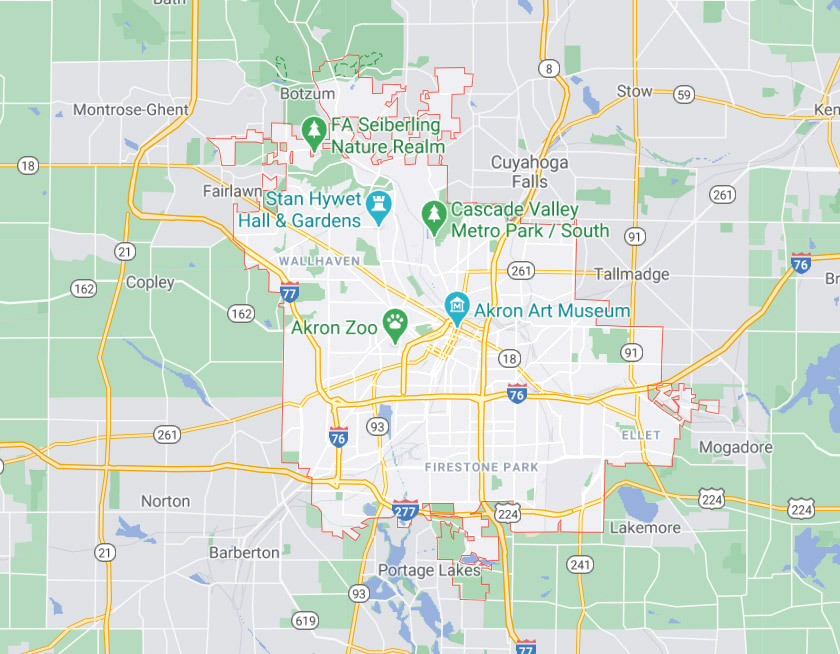

Rural Innovation loans arrive based on located area of the property, maybe not lifestyle feel. Particularly, USDA buyers need simply to discover a house in a great rural area since the outlined from the USDA. Nevertheless definition of outlying is pretty liberal: regarding 97 percent of all the U.S. home mass is eligible.

USDA Costs And you will Mortgage Insurance rates

USDA financing make it 100% funding, meaning no advance payment is needed. Simply because USDA finance is insured, otherwise supported, of the You.S. regulators.

No advance payment does not always mean customers spend large pricing. USDA loans give equivalent otherwise all the way down cost than just is obtainable that have FHA otherwise traditional fund.

USDA fund, however https://paydayloancolorado.net/sugar-city/, keeps hook downside versus Antique 97 in this it include an initial percentage of 1.00% of your own loan amount. The price isn’t needed in cash from the closing. Instead, the amount is actually covered toward dominant equilibrium and you can paid back over the years.

USDA Costs Versus FHA and you may Antique 97

That USDA money don’t need a downpayment conserves the new domestic buyer a hefty number upfront. Which reduces the amount of time it will take a buyer to help you end up being willing to purchase a home.

Other lowest-down payment choices, like FHA finance otherwise a conventional 97, however wanted a down payment of step three.5% and you will 3% correspondingly.

On mediocre home cost of from the $250,000, an effective USDA debtor would need $8,750 shorter upfront than just an enthusiastic FHA debtor.

USDA funds have a top harmony, on account of lowest down payment, but that is somewhat offset of the down prices and much more sensible mortgage insurance.

Downpayment

- USDA: $0

- FHA: $8,750

- Traditional 97: $eight,five hundred

Amount borrowed

- USDA: $252,five hundred

- FHA: $245,471

- Traditional 97: $242,500

Month-to-month Principal, Appeal, And you may Mortgage Insurance coverage

- USDA: $1,280

- FHA: $step 1,310

- Old-fashioned 97: $step one,385

Keep in mind that these money dont are almost every other will set you back including possessions fees and homeowner’s insurance, and are generally considering try, rather than live, cost and you may ple means that USDA requires an identical payment per month as compared to FHA, with no step three.5% advance payment.

As the USDA loan amount is high because of no downpayment, monthly payments are exactly the same otherwise less than additional selection.

Payment is more extremely important than just dominating balance for some consumers. Straight down monthly will cost you make the USDA mortgage more affordable to possess family which have rigorous spending plans.

Minimal Credit rating To own A beneficial USDA Financial

USDA mortgage brokers has most other gurus along with lower first and you may month-to-month will set you back. They also have flexible borrowing from the bank conditions compared to other loan types.

To own a great USDA financing, homebuyers is only going to you need a credit score out-of 640. Fannie mae assistance place the minimum credit rating at 620 for a normal 97, no matter if lenders have a tendency to typically set a higher minimum of 640 to 680.

The only real prominent mortgage system which have a diminished required credit history is FHA, and that just means a credit history away from 580.

USDA Money Constraints Make certain Accessibility Having Reasonable Earners

USDA home loans are around for customers from the otherwise below certain money restrictions. This assistance is determined in place to be sure the application form is utilized of the people that need it most.

Nevertheless the earnings restrictions to possess good USDA try generous. Is USDA qualified, our home visitors tends to make around 115% of the area’s median earnings. If in case a family of five, listed here are the brand new annual income constraints for almost all significant portion:

Huge household are permitted and work out alot more. Such as for example, a family of 5 or maybe more throughout the Los angeles town make $129,600 but still be eligible.

What are The present Prices?

Given that USDA funds is backed by the usa Institution of Farming, they provide professionals you to definitely other businesses you should never, eg small initial will set you back and you will super-lower cost.

This new reduce conditions, effortless value and you may 100% funding provided with a USDA financial allow it to be an emotional choice to conquer.

Get a good USDA price quotation, that comes that have an enthusiastic possessions and income qualifications consider. Most of the estimates are usage of the real time fico scores and you will a good individualized monthly payment guess.

*The newest payments shown significantly more than assume an excellent 720 credit history, unmarried family home, and you can assets into the Washington State. Old-fashioned 97 PMI prices are provided of the MGIC Ratefinder. Money do not include property taxation, homeowner’s insurance policies, HOA dues or other can cost you, and are also considering analogy APRs that will be meant to demonstrated an evaluation, not currently-readily available rates. Try APRs made use of are as follows: USDA cuatro% APR; FHA 3.75% APR; Conv. 97 4.25% Annual percentage rate. Talk with a lender right here to own a customized rates and you can Annual percentage rate estimate.