That is inevitably also dovetailing with how banks and others in financial services are increasingly working with AI. While many investment firms rely on fully or partially automated investment strategies, the best results are still achieved by keeping humans in the loop and combining AI insights with human analysts’ reasoning capabilities. The panelists pointed to the EU’s initiatives with its AI Act to regulate AI and create a legal framework that balances innovation and consumer protection. The complexity of AI systems necessitates a broad approach, with debates around specific prohibitions and national sovereignty in AI regulation, they stated.

Applications: How AI can

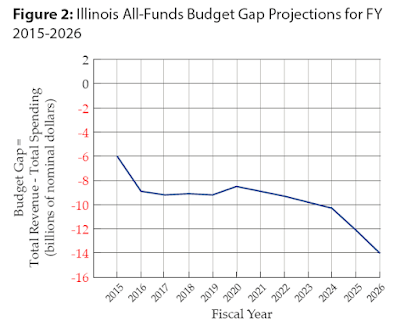

Bankruptcy and performance prediction models rely on binary classifiers that only provide two outcomes, e.g. risky–not risky, default–not default, good–bad performance. These methods may be restrictive as sometimes there is not a clear distinction between the two categories (Jones et al. 2017). Therefore, prospective research might focus on multiple outcome domains and extend the research area to other contexts, such as bond default prediction, corporate mergers, reconstructions, takeovers, and credit rating changes (Jones et al. 2017).

Improve decision-making

- As for predictions, daily news usually predicts stock returns for few days, whereas weekly news predicts returns for longer period, from one month to one quarter.

- Every day, huge quantities of digital transactions take place as users move money, pay bills, deposit checks and trade stocks online.

- Utilized by top banks in the United States, f5 provides security solutions that help financial services mitigate a variety of issues.

- Kensho, an S&P Global company, created machine learning training and data analytics software that can assess thousands of datasets and documents.

- AlphaSense is valuable to a variety of financial professionals, organizations and companies — and is especially helpful for brokers.

Prior to joining MIT Technology Review, Elizabeth held a senior executive role at The Economist Group, where her leadership stretched across business lines and included mergers and acquisitions; editorial and product creation and modernization; sales; marketing; and events. Earlier in her career, she worked as a consultant advising technology firms on market entry and international expansion. The value of AI is that it augments human capabilities and frees your employees up for more strategic tasks. Oracle’s AI is directly interactive with user behavior, for example, showing a list of the most likely values that an end-user would pick. Companies that take their time incorporating AI also run the risk of becoming less attractive to the next generation of finance professionals. 83% of millennials and 79% of Generation Z respondents said they would trust a robot over their organization’s finance team.

Predictive modeling

The right operating model for a financial-services company’s gen AI push should both enable scaling and align with the firm’s organizational structure and culture; there is no one-size-fits-all answer. An effectively designed operating model, which can change as the institution matures, is a necessary foundation for scaling gen AI effectively. https://www.business-accounting.net/cash-flow-statement-direct-method/ Its platform finds new access points for consumer credit products like home equity lines of credit, home improvement loans and even home buy-lease offerings for retirement. Figure Marketplace uses blockchain to host a platform for investors, startups and private companies to raise capital, manage equity and trade shares.

Trumid also uses its proprietary Fair Value Model Price, FVMP, to deliver real-time pricing intelligence on over 20,000 USD-denominated corporate bonds. This AI-powered prediction engine is designed to quickly analyze and adapt to changing market conditions and help deliver data-driven trading decisions. Simudyne’s platform allows financial institutions to run stress test analyses and test the waters for market contagion on large scales. The company offers simulation solutions for risk management as well as environmental, social and governance settings. Simudyne’s secure simulation software uses agent-based modeling to provide a library of code for frequently used and specialized functions.

2. AI and financial activity use-cases

Table 2 comprises the list of countries under scrutiny, and, for each of them, a list of papers that perform their analysis on that country. We can see that our sample exhibits significant geographical heterogeneity, as it covers 74 countries across all continents; however, the most investigated areas are three, that is Europe, the US and China. These results corroborate the fact that the above-mentioned regions are the leaders of the AI-driven financial industry, as suggested by PwC (2017). The United States, in particular, are considered the “early adopters” of AI and are likely to benefit the most from this source of competitive advantage.

The system runs predictive data science on information such as email addresses, phone numbers, IP addresses and proxies to investigate whether an applicant’s information is being used legitimately. Socure is used by institutions like Capital One, Chime and Wells Fargo, according to its website. Second, train staff so they have the skills to effectively interact with AI tools, building analytical capabilities that capitalize on the technology. Giving https://www.personal-accounting.org/ finance staff increased understanding of AI will also be critical in ensuring the proper security, controls, and appropriate use of the technology. AI can help deliver personalization by analyzing customer data, preferences, and behavior to provide the right product recommendations, content suggestions, and offers. Companies can also take it a step further with AI-driven customer segmentation for more-targeted marketing campaigns and promotions.

AI can then use the data to help generate financial statements, such as income statements, balance sheets, and cash flow statements, transforming the data into reports that highlight key performance indicators (KPIs), trends, and observations. GenAI can fill out the needed forms with data provided by the finance team for the staff to review and confirm. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. flexible budget Llama 3 has proven more cost-effective for developers to use than OpenAI’s models, but it often falls short of the capabilities of OpenAI’s newest GPT-4o model. Asset manager rivals, for example, include Aladdin by BlackRock, SimCorp, State Street Alpha and GoldenSource. BNY Mellon Eagle, Rimes, Clearwater Analytics and IHS Markit all offer tools for asset owners; and asset services include the likes of FIS, Temenos, Denodo, SS&C Advent and NeoXam.

The company has more than a dozen offices around the globe serving customers in industries like banking, insurance and higher education. Trained machine learning models process both current and historical transactional data to detect money laundering or other bad acts by matching patterns of transactions and behaviors. AI in finance can help reduce errors, particularly in areas where humans are prone to mistakes. High volume repetitive tasks can often lead to human error—but computers don’t have the same issue.

In finance, this often translates into applications like algorithmic trading, fraud detection, customer service enhancement, and risk management. Ensure financial services providers have robust and transparent governance, accountability, risk management and control systems relating to use of digital capabilities (particularly AI, algorithms and machine learning technology). AI is being used by banks and fintech lenders in a variety of back-office and client-facing use-cases.

She is a recipient of several scientific and industry awards including Microsoft’s top PhD thesis in the country award, Cloudera’s top AI/ML application award, Google Women in Engineering award, and a JPMC prolific inventor with 30+ patents and 60+ peer reviewed publications. Prebuilt AI solutions enable you to streamline your implementation with a ready-to-go solution for more common business problems. Oracle’s AI is embedded in Oracle Cloud ERP and does not require any additional integration or set of tools; Oracle updates its application suite quarterly to support your changing needs. Business units that do their own thing on gen AI run the risk of lacking the knowledge and best practices that can come from a more centralized approach.

While investors initially sent the stock price down following the news that Meta plans to spend billions more than originally planned building out AI data centers, the stock has since recovered. While AI introduces changes requiring adaptation, it mainly presents opportunities for efficiency and innovation in finance rather than posing a direct risk. The introduction of AI-driven automation into financial workflows results in a more agile and responsive environment. Employees are relieved from mundane tasks, leading to higher job satisfaction and productivity. The results can not only inform the finance team with better, faster information, it can influence the strategic thinking of the entire organization.

This suggests that global financial crises or unexpected financial turmoil will be likely to be anticipated and prevented. AI models execute trades with unprecedented speed and precision, taking advantage of real-time market data to unlock deeper insights and dictate where investments are made. By analyzing intricate patterns in transaction data sets, AI solutions allow financial organizations to improve risk management, which includes security, fraud, anti-money laundering (AML), know your customer (KYC) and compliance initiatives. AI is also changing the way financial organizations engage with customers, predicting their behavior and understanding their purchase preferences.

Auditing mechanisms of the model and the algorithm that sense check the results of the model against baseline datasets can help ensure that there is no unfair treatment or discrimination by the technology. Ideally, users and supervisors should be able to test scoring systems to ensure their fairness and accuracy (Citron and Pasquale, 2014[23]). Tests can also be run based on whether protected classes can be inferred from other attributes in the data, and a number of techniques can be applied to identify and/or rectify discrimination in ML models (Feldman et al., 2015[36]).