I am partnered, have a great credit rating, and you can my spouse has poor credit. Do i need to get a mortgage by myself?

I’ve been married for approximately 1 year and we wanted to acquire a condo, but my spouse has less than perfect credit which can keep us straight back on the a good mortgage. My personal credit is good. Ought i make an application for a loan without any help, with regards to purchasing a home given that a wedded person? I’d have to obtain throughout the $250,000. I am a teacher (fifteen years).

Typically, for people who as well as your spouse submit an application for that loan jointly, the financial institution will at your mutual income, combined personal debt-to-earnings (dti),and you will both of your credit scores. Whether your spouse doesn’t always have money, or if you do not require their unique money to help you be considered, then you can submit an application for that loan rather than your ex lover.

- steady money — 2 yrs or higher

- glamorous credit rating — a high credit history and you will few accidents

- reduced debt-to-money ratio — the latest quicker loans you have the better

- an advance payment — a minimum of step 3.5%, however, a great deal more is ideal

In the event that a possible borrower lacks in virtually any you to (or more) of these, the potential debtor come across qualifying for a financial loan tough.

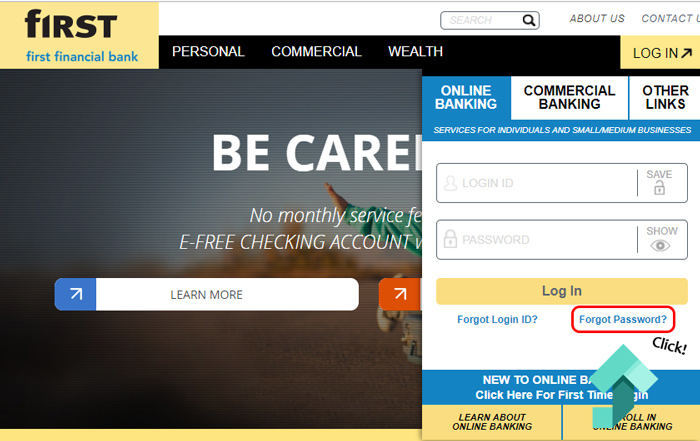

Work with a broker to see what mortgage loans you be eligible for. Download a uniform residential application for the loan (setting 1003), over they using only your revenue and credit. Upcoming, complete a moment means 1003 having one another your earnings while the money of the companion. Finally, initiate hunting. Score home loan quotes of to four pre-screened lenders regarding bills.

Reasons why you should sign up for a joint home loan

Should your lower-credit-score mate tends to make a leading money, there is certainly a spin their earnings carry out improve your dti proportion for example improve probability of obtaining financing inspite of the lower credit history.

Some partners be more secure when you look at the a property in which the title is on the fresh new book or home loan. When both partners are on a mortgage plus one lover becomes deceased, the other is also guess the mortgage and you can depending on how the brand new house is titled, the fresh new surviving partner will receive 100% possession of the property without it going through the probate process.

You’ll find legal products available you to definitely offer a non-signatory companion with the same set legally. Regarding the death of the newest mortgaged lover, the fresh new control of the property will likely be handled having a will otherwise trust. Life insurance will pay the loan in case the signatory mate passes away.

Reasons why you should not apply for a shared financial

Yet not, for those who get a mortgage yourself, your entirely bring the burden of that financial responsibility. For folks who standard you by yourself features liability. this is certainly a confident or negative depending on your direction. Let us assume your lady rebuilds their particular credit score. Why don’t we guess you and your spouse find unexpected economic problem, and get outstanding into home loan, otherwise ensure it is a property foreclosure. Your credit score will need the brand new slide, when you find yourself your spouse becomes a credit rating lifeboat that enables you one or two to continue to track down borrowing from the bank.

Or why don’t we suppose a similarly serious condition in which you and you may your wife decide to breakup. Usually one companion need to sit the latest marital assets. If so, there is is actually an excellent 50-fifty possibility the fresh new companion who has got the home in the or their own term by yourself helps to keep this new standing quo on mortgage and you may label. When your home loan are as one held there clearly was a great 100% possibility the mortgage will need to be refinanced to eradicate this new non-consuming ex lover-mate regarding the mortgage. For these several explanations i would suggest if spouses, couples, family members, or family members who wish to reside a property to one another normally be able to take action they place the possessions in a single person’s label just.

Testimonial

Earliest, an loans Atlanta efficient real estate loan officer will show you tips qualify for a mortgage. a financing administrator will help you get the best financing to your requirements. Go to the bills home loan coupons cardio to locate no-rates quotes out-of up to five pre-processed loan providers.

Second, if you have a high credit rating along with your partner does maybe not, dont to incorporate yourself to your own spouse’s playing cards. Incorporate your spouse towards the notes once the a 3rd party representative, which will help pull their credit rating right up. the newest spouse which have less than perfect credit should pay one delinquent cards otherwise levels as quickly as possible and you can negotiate a purchase erase to eradicate this type of harmful profile from their credit report.

Third, it might be important to know how a credit rating is actually calculated. A credit history is founded on numerous parameters, including:

- percentage records (have you got any late costs, charge-offs, etc.)

- the amount and kind regarding personal debt due

- people maxed-out exchange lines

- numerous supplementary circumstances as well as duration of credit score and just how of several present inquiries have been made on a credit history.

Repaying maxed-out exchange-lines commonly more often than not raise a credit rating. If you want addiitional information, please go to the newest costs borrowing from the bank financing web page.