So it complete-service standard bank are arranged in order to serve our very own top patriots; veterans, active military people as well as their family members. USAA are a combination ranging from a card union and you will a lender offering parts of one another. Created in 1922 in the San Antonio, Colorado, the organization has exploded to suffice about 77 million services participants inside nation. USAA isnt an openly replaced providers. Only people can be involved in new software USAA even offers, which allows USAA provide unique masters and you will such as the USAA mortgage cost.

USAA now offers household refinance rates which might be old-fashioned, adjustable services more 66 % of its fund was recognized by Va fund. This service membership is approximately our very own military personnel; officials, soldiers and their family. With respect to the providers, cashouts shall be paid off otherwise, for folks who search a great USAA refinance as you has come across trouble, that loan officer usually evaluate your situation and you will reveal the loan re-structuring choices. USAA work completely co-procedure toward most recent government apps.

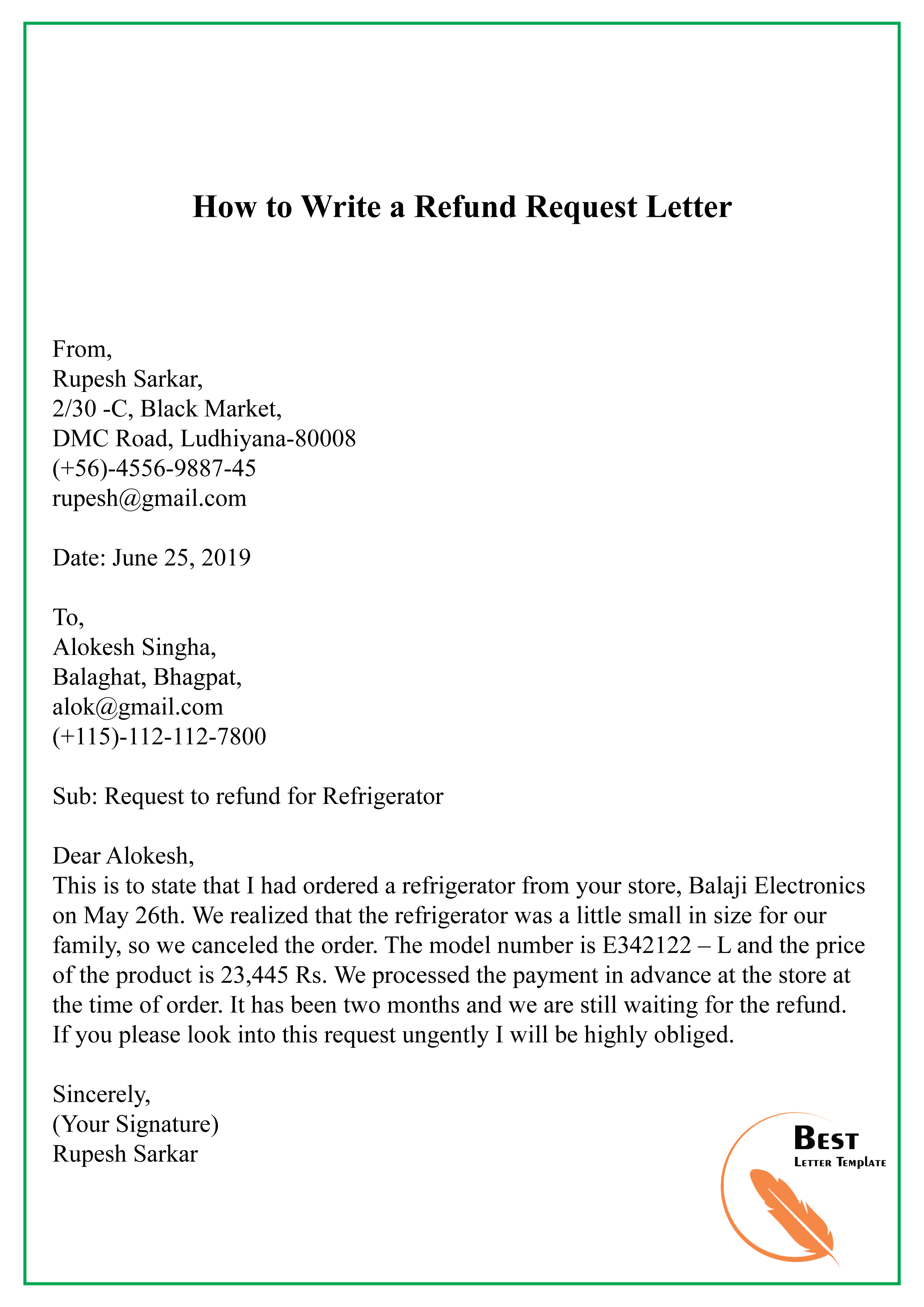

Military, retired and you may active obligations, as well as friends regarding army workers are qualified to receive USAA home loan re-finance prices (Photo/Pexels)

Refinancing facts provided by USAA

All the loan providers promote several products. View each of USAA’s refinancing rates options. Currently, USAA house refinance applications ban household collateral loans and family collateral distinctive line of credit (HELOC).

- 30- seasons fixed speed

- 20-year fixed speed

- 15- seasons repaired price

- 10-year fixed price

Just like any repaired rates financing, the pace your commit to does not adjust along the lifetime of your property loan. A fixed-rates financial renders cost management to suit your mortgage repayment smoother than simply having a variable rate home loan. USAA home loan pricing now offers terms and conditions anywhere between 10 to 31-ages. Solitary family unit members mortgage quantity usually cover during the $424,a hundred for every single industry limitation. Getting USAA refinance cost, look at the website physically, or call them towards the phone. Fundamentally, the minimum loan amount at the USAA try $fifty,100 but can go all the way to $step 3 billion. From fixed-rate mortgage alternatives from the USAA individuals is also re-finance up to 95 percent of your own worth of their house.

Sleeve money provides a shorter term than most conventional fixed-rates mortgage words but include an enticing added bonus. Brand new faster terms together with mean all the way down rates. One to downfall out of a supply is the high monthly obligations one supplement a shorter name.

USAA does not signify the terms of Arm for refinances, like many most other questions with USAA you need to have them into the cell phone. Pre-recognition process, but not, can be looked at at site: usaa. Immediately after pre-approval is completed and you may a buy bargain is within lay, this site applicant can be complete the processes cost-free by the mobile. As with any bank, the interest rate you can safe right up-side is dependent on their credit reputation and loan amount.

- Virtual assistant funds

Are a financial institution that provides family members that have military ties, it’s a good idea you to definitely USAA’s solid room is in its USAA Va mortgage offerings. More half USAA’s home loan team is inspired by Virtual assistant finance. T he no-payment Virtual assistant Interest rate Avoidance Refinance loan Blue Springs personal loan with no bank account (IRRRL) is tough to beat some other financial institutions. USAA together with allows Va consumers to help you refinance up to completely of your own property value their home. USAA formations their Virtual assistant loans within the ten-, 15-, 20- and 31-year terms.

USAA mortgage rates now

USAA refinance costs are very aggressive for other costs regarding the sector. USAA will take a homeowner’s latest loans weight and you can record to the planning when you look at the deciding upon a good refinancing rates. USAA’s online have you should never customized prices of the topography, credit history, and other information. To get latest and you will designed costs for the finances, you will need to phone call USAA really.

How can USAA’s things compare to other banking institutions?

USAA against. Pursue bank Whenever you are entitled to a great Va mortgage, otherwise a keen IRRRL it will be is sensible on the best way to start your research from the USAA. Once we said, there are not any charge associated with IRRRL financing, and therefore Chase you should never already overcome. Outside of the IRRRL money, USAA charge a good .50 percent origination commission. If you would like safe an arm financing or a low-Virtual assistant repaired price home loan, store one another finance companies. He could be competitive with almost every other mortgage product rates and their origination charges could well be equivalent.

USAA versus. PNC home loan USAA does not already have a look at alternative types of credit history, such as lease money, in terms of somebody’s overall credit profile. PNC do. The credit profile is among the areas one influence your speed. Should your credit score needs particular repairs, but refinancing cannot hold off, you can believe looking on PNC first, even though you would like to protected a beneficial Va loan.

USAA compared to. Navy Government Given that several other financial institution concerned about helping army professionals as well as their group evaluating Navy Federal to help you USAA to have Va loan ventures is important getting review. If you’re each other cities state they create 50 % or more off its financial providers thanks to Va, Navy Government can’t contend with zero commission IRRRL one USAA also offers. And additionally, Navy Federal fees a top origination payment of the .50 percent. Toe to help you toe, USAA appears to pull ahead a bit of Navy Federal.

Other factors when picking an effective refinance device

USAA does not already bring family guarantee funds otherwise family security distinctive line of credit (HELOC). They could potentially bring the product up to speed towards the end away from 2017. USAA in addition to does not give the involvement within the HARP fund.

Due to the fact USAA listens in order to the participants and you will works to ensure that they may not be that was left behind contained in this extremely charged and you may changing property and you can loan business, the firm looks dedicated to services and you can assistance for these spent inside. Working to compete, the firm certainly respects its goal and you can actively works to improve for the overall performance particularly into the technology front.

Choosing and that option is right for you

It’s always best to comparison shop to discover the best mortgage speed in terms of refinancing. From the examining your own personal situation, there are certainly and that products make the most experience for you. When you’re eligible for USAA home loan interest rates there are specific advantages to are aside regarding the standard bank including the USAA IRRRL equipment. Finding the right lender isn’t constantly on the rates of interest, furthermore better to envision customer service and you may positioning along with your viewpoints.

Into wide variety front side, there are numerous charge that will accompany a refi. No matter what bank you are considering, constantly carry out the math to see if the new costs counterbalance the rate of interest. You could find that banking companies that have highest interest rates might possibly be economical in the long run.

During the an environment where our services employees demands every service and you will insights we can pick, the firm appears to be a good investment for those away from united states hoping to make sure all of our provider patriots as well as their parents try maintained safely.