Are you currently a primary-day house customer for the Mississippi? In this case, you should stand upgraded on the basic-day home consumer has when you look at the Mississippi. Really, look not any longer since the Overall Home loan has got your secured!The audience is your reputable companion in selecting a knowledgeable home loan offer in the Magnolia Claim that fits the traditional and you will funds. With the complete Financial party, you’ll unlock the entranceway on the fantasy household by using the reasonable financial pricing and you can down payment recommendations apps inside Mississippi. Call us today to have home loan direction within the Mississipi.

For those who have any questions regarding the protecting an informed mortgage cost inside Mississippi, delight contact us today. Our company is here that will help you to locate the mortgage pricing you to definitely work best with your circumstances.

MHC Smart6

https://www.cashadvancecompass.com/loans/no-origination-fee-personal-loan

The S of Mississippi Home Agency will bring 29-season mortgages during the reduced & lucrative costs minimizing mortgage insurance fees. Selection were Freddie Mac’s 97% funding, FHA, Virtual assistant, and you will USDA financial support, used in conjunction with down-payment recommendations during the Mississippi.

This is certainly good program getting repeat and earliest-date home buyers during the Mississippi who’re to acquire residential property in which state. The house or property might be just one-loved ones, condo, townhome, otherwise duplex. If someone else is eligible to possess an FHA loan, they are able to discover a produced family. Government income limits become children earnings off $122,000.

MHC Wise Services 2nd

When you obtain a mortgage as a consequence of MHC’s S when you look at the Mississippi, you qualify for new Wise Solution 2nd down payment assistance. Lower than this choice, you might located around $6,000 into the help just like the a second mortgage on no % notice.

Financial credit certificate (MCC)

To own Mississippi very first-time homeowners, home financing Credit Certificate can aid in reducing government taxes. This means that the credit can also be coverage around forty% of the annual financial attract up to $2000 annually. MCC can help you end up being entitled to a mortgage in the Mississippi and then make the domestic possession much more finances-friendly. Remember that earliest-time homebuyers into the Mississippi need surpass household earnings conditions established to your price limitations and you will condition.

Do you need to live-in Jackson making use of the financial guidance within the Mississipi? In this case, your perfect can turn to the a real possibility. All you need to get a hold of is if you match the program’s qualification conditions: the brand new applicant’s income must be on or less than 80% AMI. Now, when you are qualified, you should buy one minute mortgage for approximately $ fifteen,000 or more. There are no monthly premiums, with an excellent 0% rate of interest, and you may part of the borrowed funds is actually forgiven yearly until it clears. Discover one nuanced needs: homeownership degree degree. The actual only real downside is that the purchase price of your 2nd home must be $156,000 and you may below. Finding the optimum family according to which requisite can be tricky and you will time-sipping.

DPA14

The fresh new MHC and also the Board of Supervisors out of Coahoma, Tunica, and you will Arizona areas bring a 30-season fixed-rates mortgage during the a profitable speed from the proceeds of your profit off Financial Cash Bonds.

Which MS basic-big date house buyer program now offers total help of $14000 ( an effective $7,000 forgivable financing and a good $seven,000 offer) which have initial will cost you connected with their domestic property’s purchase. It greatest program will run till .

FHA Mortgage

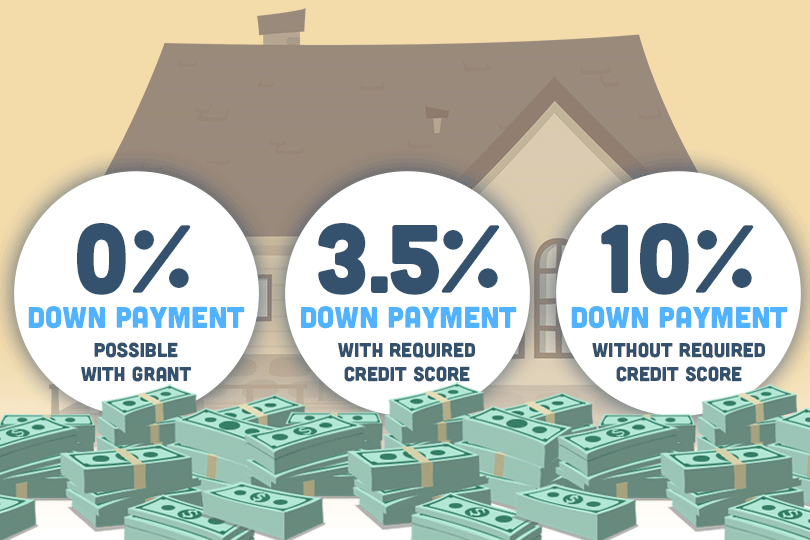

This is an excellent choice for very first-date home buyers inside the Mississippi when you have a decreased borrowing history. Only step 3.5% of home’s price and a credit rating out-of 580 is enough to leave you entitled to FHA loans for the Mississippi.

Va Financing

Pros Factors Institution claims homebuyers do not require a down percentage otherwise the absolute minimum credit history to acquire Va loans in Mississippi. He’s available to being qualified experts, provider participants, and qualified spouses.

USDA Mortgage

Just like Virtual assistant financing, USDA mortgage when you look at the Mississippi don’t require people advance payment. A credit score of 640 helps you get your earliest family in the MS when you look at the a designated area as a result of this type of loans.

Inclusion from a course on this web site will not constitute a keen approval because of the Complete Home loan and won’t verify the qualification otherwise acceptance into program.